What is Zoho Books

Zoho Books: Your Introduction to Modern Accounting

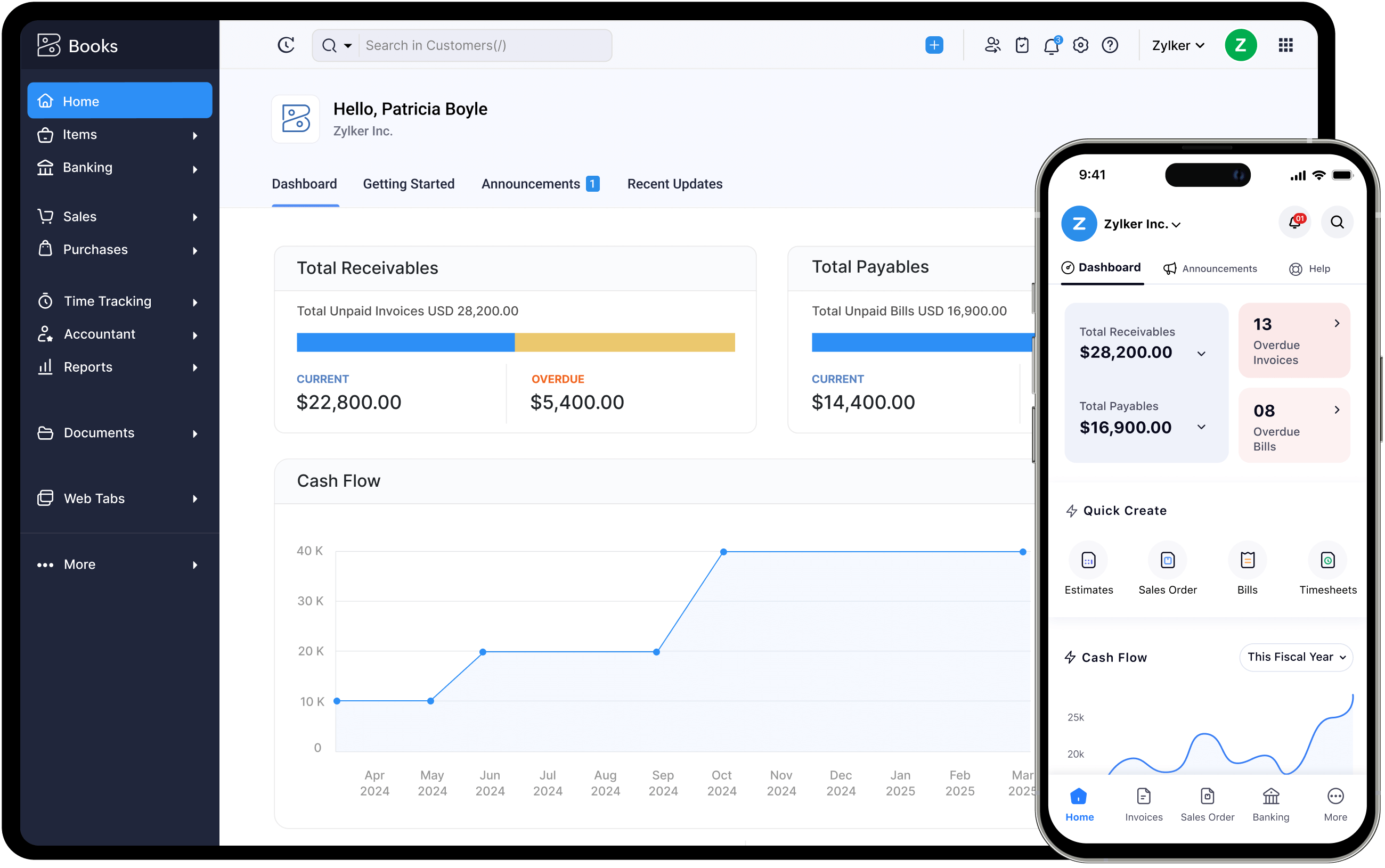

Zoho Books is a user-friendly, cloud-based accounting software that makes it easy to understand and manage the finances of small and medium-sized businesses. It works like a powerful calculator and smart organizer combined, helping you handle invoices, expenses, reports, and more with ease. Think of it as your personal guide to navigating the world of business finance—simple, efficient, and always accessible.

Zoho Books is developed by Zoho Corporation, a global technology company known for building powerful, user-friendly business software. Founded in 1996, Zoho Corporation offers a suite of over 55+ cloud-based applications that support everything from accounting and CRM to HR, project management, and analytics. With a strong focus on privacy, innovation, and affordability, Zoho serves millions of users worldwide. The company is headquartered in Chennai, India, and Austin, USA, and is widely respected for creating reliable, accessible tools that help businesses simplify their operations and grow efficiently.

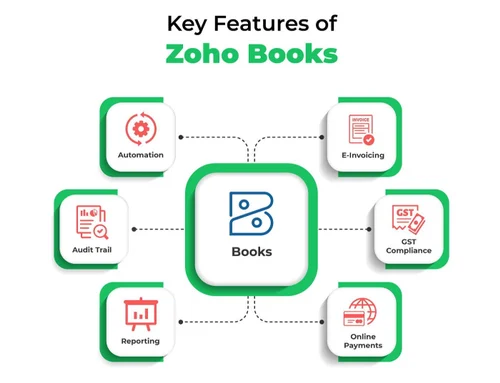

Key Features of Zoho Books: What It Can Do For You

Zoho Books is packed with powerful features designed to make accounting simpler, smarter, and more efficient for businesses of all sizes. From automated invoicing and expense tracking to seamless bank reconciliation and GST-compliant filings, Zoho Books helps you manage every financial aspect with ease. Its intuitive dashboards, real-time reports, and multi-user collaboration ensure you stay in control of your finances at all times. Whether you're a small business, freelancer, or growing enterprise, Zoho Books streamlines your accounting process so you can focus more on your business and less on manual paperwork.

You'll learn how to:

- Create Invoices: Learn to make professional-looking bills to send to customers for payment.

- Track Expenses: See where the money is going by categorizing and tracking different types of expenses.

- Reconcile Bank Accounts: Match your bank statements with your Zoho Books records to ensure accuracy.

- Manage Inventory: Keep track of the products you have in stock and their value.

- Generate Reports: Create reports to see how your business is doing financially.

- Automate Tasks: Set up automatic reminders and other helpful automations to save time.

- Connect to Other Apps: Link Zoho Books with other useful tools to share information.

Why Learn Zoho Books: Your Future Skills

Here’s why learning Zoho Books can be valuable for your future: Zoho Books is one of the most widely used cloud-based accounting platforms, offering powerful tools for invoicing, GST compliance, bank reconciliation, reporting, and automation. Mastering Zoho Books not only strengthens your accounting skills but also increases your employability, as businesses increasingly prefer accountants who can work with modern, technology-driven systems. Whether you plan to work in a firm, manage your own clients, or start a business, proficiency in Zoho Books gives you a strong competitive edge and opens doors to numerous career opportunities in finance and accounting.

- Accounting Made Easy: Understand basic accounting principles in a practical, hands-on way.

- Job Ready Skills: Many companies use Zoho Books, so knowing it can help you get a job.

- Improved Understanding of Business: Learn how businesses track their money and make financial decisions.

- Career Flexibility: Zoho Certified people have a high earning and hiring rate.

By learning Zoho Books, you'll gain valuable skills that can help you succeed in a variety of careers related to business and finance!

Multiple Choice Questions:

Zoho Books is mainly used by

Zoho Books helps businesses to